Boost Your Cashflow

Try Clearitt’s Cashflow Monitor & Invoice Clearing For Free

Get Your Cashflow

Health Check.

Over and

Over Again.

Daily Cashflow Monitor

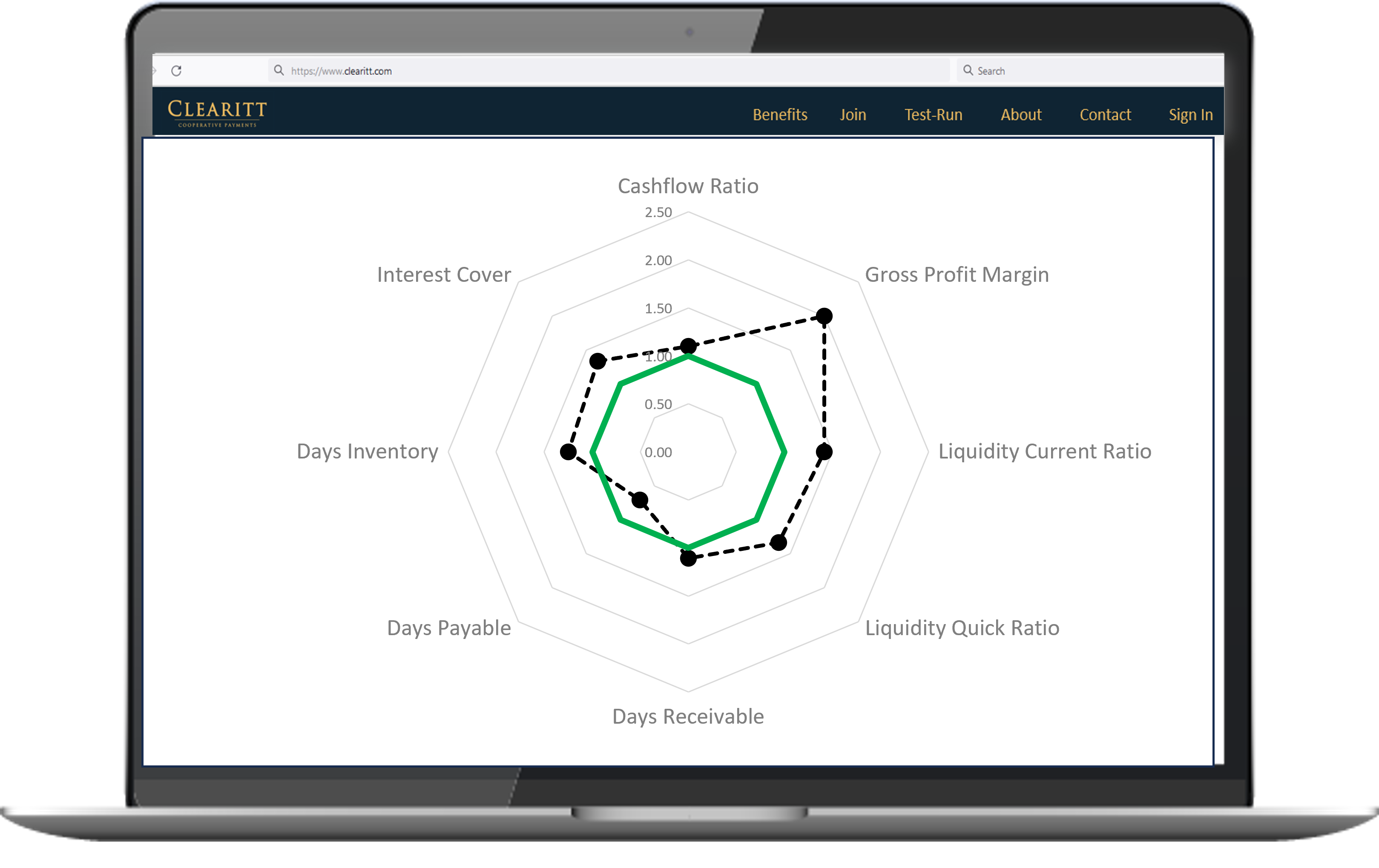

One very important part of running a business is to monitor the cashflow. So what could be better than getting a free trial to a state-of-the-art cashflow Monitor? The Cashflow Monitor visualises seven cashflow KPIs:

- Cashflow

- Gross Profit Margin

- Liquidity Current Ratio

- Liquidity Quick Ratio

- Days Receivable

- Days Payable

- Days Inventory

- Interest Cover

By comparing against industry benchmarks, the Cashflow Monitor also allows you to see what you are doing well and what you can improve.

Key Benefits

Daily Cashflow Control

- A comprehensive overview of the cashflow

- Better understanding of various aspects

Benchmarking

- How good is good enough for the business

- What would needs improvement

Financial Protection

- Showcase you own financial stability

- Ask customers and suppliers to do the same

Minimise Your

Cash Needs.

Invoice Clearing

is the Future.

Invoice Payments Clearing

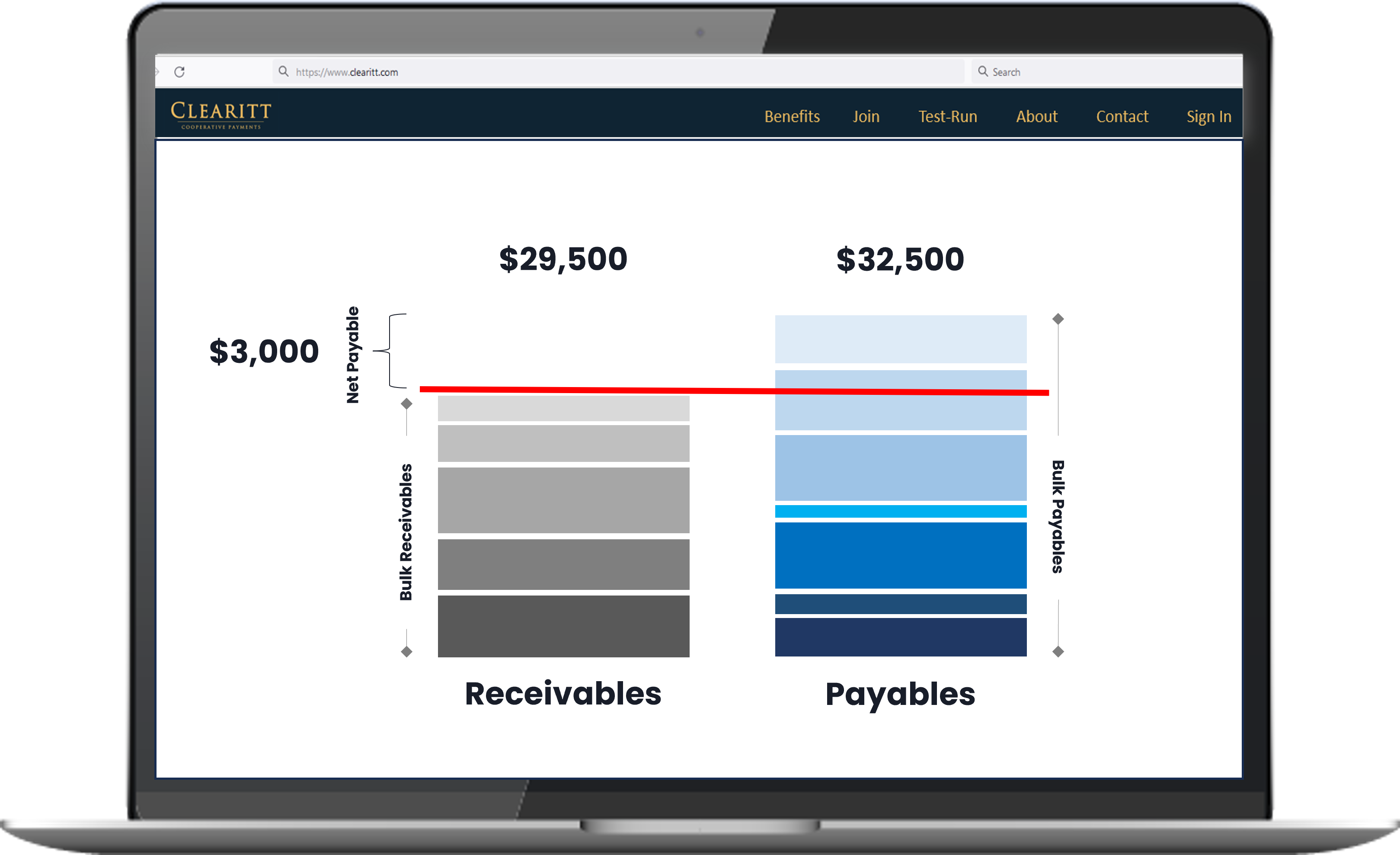

Over 250 years ago, banks started to cooperate to minimise or eliminate the need for cash payments between themselves. They did this by offsetting the incoming payments against the outgoing, so that they only had to settle the difference. This is called clearing.

In the same way, with Clearitt’s innovative solution, you can now offset your incoming invoices against your outgoing invoices and keep trading with less cash. We call this Cooperative Payments.

You can start using the Payments Clearing as soon as your customers and suppliers also are part of the Clearitt Community. Due to the cooperative nature of clearing, this is a transition that might take some time.

This works the same way other community networks work, like LinkedIn for example. When you started, very few of your contacts were connected to you and then soon most of your contacts were.

We will facilitate this for you and use the technology to help you reach out to them. You can use the platform to reach out to your contacts, alongside your other more direct efforts.

Key Benefits

Time Savings

- No more chasing clients for payment

- Less time spent on transaction management

- Do business without payment issues

- Easier to find new customers

Boosting Working Capital

- No need for excess cash balances

- Frees up working capital for sales

- Frees up working capital for more staff

- Frees up working capital for investments

Cost Savings

- No more expensive working capital loans

- No more expensive factoring

- Lower gross GST payments

- No expensive credit cards needed

Experience the power of Clearitt’s innovative cashflow solutions, absolutely free for 6 months!

Free Cash Flow Monitor 6 Months

- Free access to Clearitt’s Cash Flow Monitor for six months

- Syncing with your accounting platform

- Regular Pricing: $19 / month

- Monitor your cash flow like pro with daily updates

No Clearing Fees for 6 Months

- You will not pay any clearing fees for the first 6 months

- Syncing with your accounting platform

- Regular Pricing: 0.1% of whatever invoice amount we can clear

- For example, if we can offset and you don’t have to pay $10,000, our clearing fee would be $10

You can end the service at any time without any cost. No sneaky terms, just a sincere eagerness to make things easier for small- and medium-sized businesses.

Privacy Policy

Clearitt Australia Pty Ltd (ACN 627 579 480) is committed to providing quality services to you and this policy outlines our ongoing obligations to you in respect of how we manage your Personal Information.

We have adopted the Australian Privacy Principles (APPs) contained in the Privacy Act 1988 (Cth) (the Privacy Act). The NPPs govern the way in which we collect, use, disclose, store, secure and dispose of your Personal Information.

A copy of the Australian Privacy Principles may be obtained from the website of The Office of the Australian Information Commissioner at www.aoic.gov.au

What is Personal Information and why do we collect it?

Personal Information is information or an opinion that identifies an individual. Examples of Personal Information we collect include: names, addresses, email addresses, phone and facsimile numbers.

This Personal Information is obtained in many ways including by telephone, by email, from your website, from media and publications, from other publicly available sources and from third parties. We don’t guarantee website links or policy of authorised third parties.

We collect your Personal Information for the primary purpose of providing our services to you, providing information to our clients and marketing. We may also use your Personal Information for secondary purposes closely related to the primary purpose, in circumstances where you would rea son ably expect such use or disclosure. You may unsubscribe from our mailing/marketing lists at any time by contacting us in writing.

When we collect Personal Information we will, where appropriate and where possible, explain to you why we are collecting the information and how we plan to use it.

Sensitive Information

Sensitive information is defined in the Privacy Act to include information or opinion about such things as an individual’s racial or ethnic origin, political opinions, membership of a political association, religious or philosophical beliefs, membership of a trade union or other professional body, criminal record or health information.

Sensitive information will be used by us only:

- For the primary purpose for which it was obtained

- For a secondary purpose that is directly related to the primary purpose

- With your consent; or where required or authorised by law.

Third Parties

Where reasonable and practicable to do so, we will collect your Personal Information only from you. However, in some circumstances we may be provided with

information by third parties. In such a case we will take reasonable steps to ensure that you are made aware of the information provided to us by the third party.

Disclosure of Personal Information

Your Personal Information may be disclosed in a number of circumstances including the following:

- Third parties where you consent to the use or disclosure; and

- Where required or authorised by law.

Security of Personal Information

Your Personal Information is stored in a manner that reasonably protects it from misuse and loss and from unauthorized access, modification or disclosure.

When your Personal Information is no longer needed for the purpose for which it was obtained, we will take reasonable steps to destroy or permanently deidentify your

Personal Information. However, most of the Personal Information is or will be stored in client files which will be kept by us for a minimum of 7 years.

Access to your Personal Information

You may access the Personal Information we hold about you and to update and/or correct it, subject to certain exceptions. If you wish to access your Personal Information, please contact us in writing.

Clearitt Australia Pty Ltd will not charge any fee for your access request, but may charge an administrative fee for providing a copy of your Personal Information.

In order to protect your Personal Information we may require identification from you before releasing the requested information.

Maintaining the Quality of your Personal Information

It is an important to us that your Personal Information is up to date. We will take reasonable steps to make sure that your Personal Information is accurate, complete and up to date. If you find that the information we have is not up to date or is inaccurate, please advise us as soon as practicable so we can update our records and ensure we can continue to provide quality services to you.

Policy Updates

This Policy may change from time to time and is available on our website.

Privacy Policy Complaints and Enquiries

If you have any queries or complaints about our Privacy Policy please contact us at:

Clearitt Australia Pty Ltd

Email: info@clearitt.com

Address: 201 Kent Street, Sydney NSW 2000

Last update: 08/06/2023